ACTIVITY REPORT

- HTL Project Update: Preparing for 2026 Commissioning (18/12/2025)High Titanium Resources & Technology Limited (HTL) is hitting key milestones in site development and regulatory approvals to ensure a successful commissioning phase in 2026.

Regulatory Approvals: The Progressive Rehabilitation and Closure Plan (PRCP) schedule is accepted and progressing on track. The Estimated Rehabilitation Cost (ERC) application has been submitted and is awaiting assessment.

Infrastructure & Logistics: A Road Safety Audit (RSA) is currently underway, with a Road Impact Assessment (RIA) to follow to support our northern transport route. Preliminary work for the new Port Storage Facility Development Application (DA) has also been initiated.

Landholder Relations: Compensation has been partially paid.

All major tasks are advancing as planned. We remain committed to a seamless transition into operations next year.

- HTL has officially lodged PRCP (Progressive Rehabilitation and

Closure Plan) application. (14/07/2025) - PRCP Progress Update (05/05/2025)Our Progressive Rehabilitation and Closure Plan (PRCP) is advancing steadily. Key technical studies, including geochemistry, landform design, and groundwater assessments, have been completed or are underway.We have commenced the drafting and consultation stages with relevant Queensland regulatory bodies and are preparing for formal submission. The plan remains on track for completion by the end of 2025, aligned with our broader development timeline and environmental commitments.

- HTL Attends Titanium Industry Conference in Xiamen (28/01/2025)We are excited to announce that HTL participated in the Titanium Industry Conference held in Xiamen before the end of last year. Our team had the opportunity to showcase our latest products and innovations, receiving an overwhelmingly positive response from downstream enterprises. Our product specifications were highly appreciated, demonstrating our continued commitment to providing high-quality titanium products for the industry.We are proud of our achievements and look forward to further collaborations and partnerships within the titanium industry. Stay tuned for more updates as we continue to lead the way in high-titanium resource technology.

- Port infrastructure upgrade (01/03/2024)The $21 million project of a 250-metre-long conveyor belt at the Port of Bundaberg was completed in August last year, and commissioning was successful afterwards. It will allow a wider range of products to be loaded from the port at a much faster rate, including HTL’s ilmenite for exporting. Recently common user stockpile on port construction has commenced and it will benefit all port users for faster loading at lower cost.

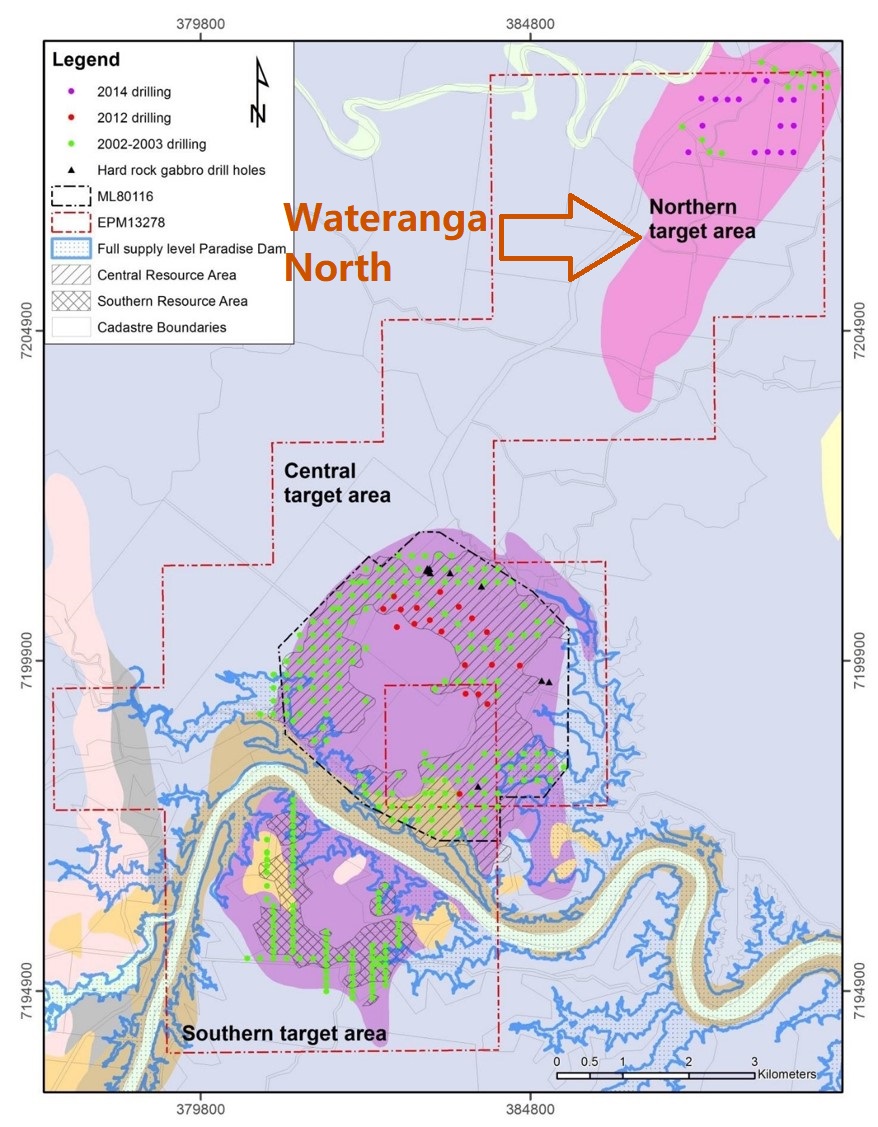

- Further exploration plan (23/05/2023)HTL has received exploration proposal for the northern area of the tenement. The proposal includes two stage of works. 50 drillings will be completed for stage 1 to produce a report of drilling results. Potential gold and copper mineralisation will also be target of the exploration.

- Mineral Resource Estimate & Valuation (07/11/2022)Mineral Resource Estimate & Valuation report has been completed by MEC Mining. The resource of Wateranga Project has been remodelled with resource valuation increased by more than 20% comparing to the earlier valuation report. The main reasons are the substantial increase of ilmenite price and the exchange rate changes.

- Haulage route optimization (30/09/2022)Meeting was organized between HTL, North Burnett Regional Council, Department of Transport and Main Roads and Department of State Development recently to discuss HTL’s plan of optimizing haulage route to reduce logistic cost. Update had been given to all involved parties about how we plan to shorten the haulage time. Feedback has been received that 19m B-double operation is permitted with current road condition.

- Mine site visit (21/09/2022)As the financing of the project is expected to be finalized in the near future, we visited our mine site and Port of Bundaberg in preparation of incoming site development. Meeting was arranged on site and port respectively to optimize mine plan and logistic. HTL also followed up with local council, Department of Transport and Main Roads and Department of State Development to give update on schedule of our development. HTL has been advised that our project development will be strongly supported by the department.

- Equity investment term sheet signed (05/09/2022)HTL has signed term sheet for proposed equity investment to HTL from newly formed mining investment fund. The purpose of the equity investment is to fully fund the development of Wateranga Project. David Li, CEO of HTL, has been invited to be director of the mining investment fund. Formal offer will be disclosed to all shareholders for general meeting voting as soon as received.

- Wide Bay Burnett Minerals Region Investment Prospectus Launch (13/09/2021)The Wide Bay Burnett Minerals Region Investment Prospectus has been launched by Hon Scott Steward MP, Minister of Resources in the event on 6 September 2021.

Featuring HTL’s mineral sand project Wateranga as one of the most advanced project in the region, the Wide Bay Burnett Minerals Region Investment Prospectus has been prepared on behalf of the Wide Bay Burnett Resources Group, with the support of the Queensland Government through the Department of State Development, Infrastructure, Local Government and Planning along with Trade and Investment Queensland, the Wide Bay Burnett Regional Organisation of Councils, Regional Development Australia Wide Bay Burnett, and the Queensland Resources Council.

Featuring HTL’s mineral sand project Wateranga as one of the most advanced project in the region, the Wide Bay Burnett Minerals Region Investment Prospectus has been prepared on behalf of the Wide Bay Burnett Resources Group, with the support of the Queensland Government through the Department of State Development, Infrastructure, Local Government and Planning along with Trade and Investment Queensland, the Wide Bay Burnett Regional Organisation of Councils, Regional Development Australia Wide Bay Burnett, and the Queensland Resources Council. - Submission of a progressive rehabilitation and closure plan (05/04/2021)As part of final statutory process prior to the mining of Wateranga project, HTL has submitted progressive rehabilitation and closure plan (PRC plan) on 29 April 2021 to Department of Environment as requirement of mining activity relating to our mining lease ML80116 for the Central area tenement covering 1500 hectares.

- Progressive rehabilitation and closure plan (PRCP) (19/10/2020)HTL has engaged Department of Environment and Science (DES) for the application of PRCP. A pre-lodgement meeting was held last month and HTL will prepare and submit a proposed PRCP that meets the new requirements by 30 April 2021.

- Wide Bay Burnett Resources Group(WBBRG) meeting online(03/09/2020)The Wide Bay Burnett Resources Group(WBBRG) meeting was held online on 25 August 2020 due to the COVID-19 pandemic. As initial member of the regional group formed by state departments, local councils, mining companies and industrial experts, HTL reported the progress of the company including the recent execution of Investment, Mining and Offtake Agreement. As one of the most advanced developing resource project within the region, HTL plans to kick off the project in early 2021. With new policy and government fund to be introduced to stimulate the regional economy growth, HTL believes that the success of Wateranga Project will contribute to the recovery of regional economy.

- HTL is establishing cooperative relationship with an European company (26/08/2020)HTL is further establishing a cooperative relationship with an European based company that intends to finance HTL’s mineral sand project and also offtake part of ilmenite product. Both parties have signed MOU of offtake and investment , are willing to move forward to establish comprehensive cooperation relationship in the near future. The HTL board believes the potential cooperation will reinforce the set objective in terms of diversifying the market to reduce the risk.

- HTL in support of Biggenden Bridge upgrade (25/08/2020)HTL expressed our support for the upgrade of the Biggenden bridge in a letter through the Wide Bay Burnett Resources Group to the Minister of Transport and Transportation (TMR) of Queensland. As the transit point of the HTL’s established transportation route, the upgrade of the Biggenden Bridge will improve the road transportation conditions of HTL’s Wateranga project during the transportation of ore and reduce transportation costs accordingly. We look forward to seeing this plan realized as soon as possible. HTL is a founding member of the Wide Bay Burnett Resources Group and will support the local economic, cultural and environmental development on a long-term basis.

- TIQ – HTL lends helping hand in Wide Bay Burnett (22/07/2020)

- Freight route to be improved by upgrading bridges (29/06/2020)State Government were going to fund $5M dollars for the John Peterson Bridge on top of the $20M that the Federal Government had already committed. This bridge upgrade is an action of boosting regional economy and industries and businesses around will benefit from it, including our Wateranga Project.

- Port of Bundaberg Common User Facility (CUF) (17/06/2020)HTL has provided letter of intent to support the CUF development on Port of Bundaberg. Once the proposed facilities including a new conveyor system built, HTL and other future users of the Port of Bundaberg will receive service with better quality and price.

- QLD Border crossing exemptions application (12/06/2020)HTL has made border crossing exemptions application along with other mining companies through Wide Bay Burnett Resource Group. A letter has been drafted to Minister of Natural Resources, Mines & Energy in Queensland to request the Queensland Government provide border crossing exemptions for personnel engaged in exploration and mine development on application. We wish the exemption could be granted soon to enable HTL and other mining companies to develop projects as normal.

- Donation to local community under COVID-19 situation (18/05/2020)David Li, CEO of HTL, has made donation of over 1,000 bottles of hand sanitizer to North Burnett Community Service. As part of the community, HTL hopes everyone keep safe during this strange time. Together we can help stop the spread and stay healthy.

- Investment proposal has been received(20/02/2020)One of major shareholders of HTL has submitted draft proposal for further investing in Wateranga project to initiate the project. The board of HTL is currently reviewing the proposal

- Wateranga project update(14/02/2020)HTL has received fee proposal for mining works of Wateranga, meanwhile we are finalising details of processing plant with potential EPCM contractor.

- Offtake MOU has been signed(22/01/2020)Offtake MOU between HTL and GBS has been executed. GBS is a Germany registered company intends to offtake HTL’s ilmenite for its smeltery in Queensland Australia. Both parties will keep working together to form a formal document in the future.

- Corporate Services Contract for funding has been executed(23/10/2019)HTL is negotiating a deal with a European based company that intends to finance HTL’s mineral sand project and also offtake ilmenite product in the near future. To facilitate this cooperation, HTL has entered into a Corporate Services Contract with a financier.

- Meeting with potential cornerstone investor(10/10/2019)HTL held a friendly meeting with potential cornerstone investors. The two parties conducted in-depth discussions on project development strategies and directions, downstream markets, and cooperation models. The two sides will further establish the details of the cooperation, and strive to put the high-quality titanium resources of Wateranga into production and bring them to market as soon as possible.

- HTL’s Marketing Director and Chief Representative of China has been appointed(09/07/2019)Mr.Liu Kai has been appointed as HTL’s Marketing Director and Chief Representative of China to expand the company’s business in China region.Kai Liu graduated from Ocean University of China in 1993, majoring in international economics. He is CEO and founder of multiple investment firms. His business success covers the area of mining, retail, real estate, transport, finance, and tourism in the last 20 years. He is specialized in international investment & trading, including successful investment in Australia, Africa and Asia. We expect his vast experience could benefit the company in overseas market.

- Partnership with Industrial leading advisors(26/04/2019)HTL is entering into production stage and currently undertaking all necessary preparation works. To achieve optimal outcomes from the Wateranga Project, HTL is establishing comprehensive cooperation with industrial leading advisors such as TZMI. HTL believes that maintaining good communication with the industry will contribute to the success of our commissioning and benefit the company in a long run.

- New conveyer at the Port of Bundaberg has been funded(11/04/2019)The government has committed $10 million to the construction of a multi-use conveyer at the Port of Bundaberg – which is the port that HTL will use for stockpiling & shipment of mineral products. The new conveyer will connect stockpile area and ship loading area. It is believed the new conveyer could greatly save loading time and cost for shipment.

- HTL AGM 2018 has concluded ( 03/04/2019)HTL AGM 2018 has concluded on 29 March 2019. The Consolidated Financial Statement with audit report was circulated to all attendees before the commencement of the AGM. If you are shareholders of HTL and you did not attend the AGM, please contact us by email: echen@htl.net.au to obtain a copy of the report. Minutes of the meeting is also available upon request.

- Draft Investment Framework Agreement received(25/02/2019)HTL has received draft Investment Framework Agreement from a resource company listed in Hong Kong. According to the agreement, its subsidiary fund company will provide funding into development & construction of Wateranga Project, meanwhile to complete HTL’s listing in Hong Kong. The concrete work is in progress.

- Port Update (17/12/2018)It has been confirmed in a teleconference meeting with Port of Bundaberg that HTL could use vessel with minimum capacity of 25,000 ton for ilmenite shipment due to improved port facilities.

- Plan of Operations has been lodged (27/11/2018)HTL has lodged Plan of Operations(PoO) for Mining Lease 80116 of Wateranga Project. A plan of operations provides details about how we intend to meet environmental authority (EA) conditions, including rehabilitation requirements.

- Meetings with DSD and NBRC during site visit (30/07/2018)HTL had a meeting with The Department of State Development (DSD) and North Burnett Regional Council (NBRC) respectively along with HTL’s business partners during our site visit between 19 and 22 July 2018. The purpose of the meetings is to give updates about HTL’s next-step development plan of Wateranga Project. As a shovel ready mining project within the region, HTL is planning to employ 50 staff and workers from regional area for the stage 1 of Wateranga Project. HTL believes this project will bring long-term prosperity to the region and communities, and HTL will continue to build more connections with local communities through this flagship project.

- Preparation works before disturbance of central Wateranga Project (27/07/2018)The board of HTL has advised the commencement of preparation works before disturbance of central Wateranga Project, as known as ML80116 area. Key documents including Risk Management System, Water Management Plan and Plan of Operation are undertaken respectively. Those works are expected to be finalised within one month time.

- 2018 Ttianium Feedstock Conference (16/05/2018)HTL is invited to attend 2018 Ttianium Feedstock Conference in China on 23 & 24 May 2018 as one of the speakers to present Wateranga Project. During the two-days event, HTL will also meet with upstream-downstream companies, including a listed company on Shanghai Stock Exchange who had expressed intention of cooperation for the development of Wateranga Project and potential offtake of ilmenite to be produced by HTL.

- Wide Bay Burnett Resources Group(WBBRG) meeting (20/04/2018)HTL attended the Wide Bay Burnett Resources Group(WBBRG) meeting on 12 April 2018 in Brisbane. As initial member of the regional group formed by state departments, local councils, mining companies and industrial experts, HTL reported the progress of the company including the recent grant of mining lease. Accordingly the Wateranga Project of HTL is recognized as one of the most advanced developing resource project within the region.

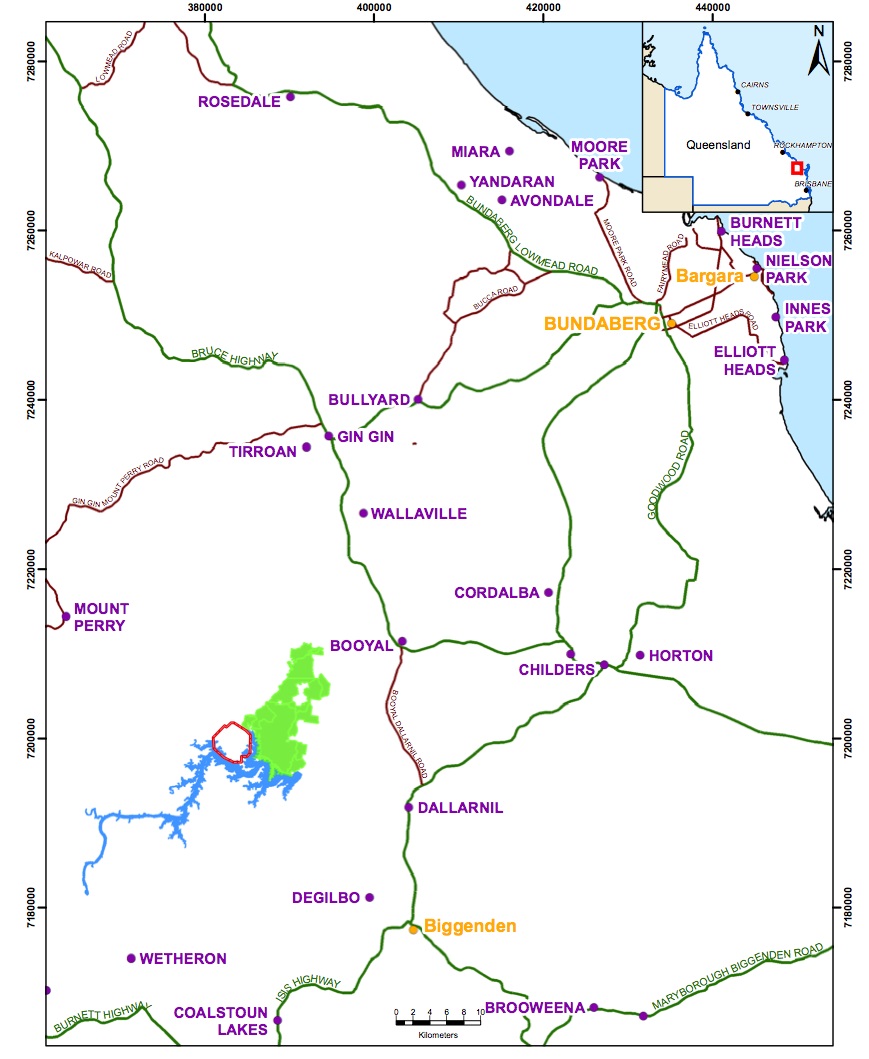

Regional resources profiles and mapping is also updated during the meeting by Department of State Development, from which the state departments would determine directions of infrastructure improvements to better serve regional resources companies. - Mining Lease Grant Notification (10/04/2018)HTL has commissioned our tenement management company to notify the grant of mining lease to the landholders of the tenement.

- HTL AGM 2017 has concluded ( 06/04/2018)HTL AGM 2017 has concluded on 29 March 2018. The Consolidated Financial Statement with audit report was circulated to all attendees before the commencement of the AGM. If you are shareholders of HTL and you did not attend the AGM, please contact us by email: echen@htl.net.au to obtain a copy of the report. Minutes of the meeting is also available upon request.

- Mine manager candidate interviewed (12/02/2018)HTL has interviewed mine manager candidate who is local resident of Mount Perry, the nearest township of Wateranga Project.The interviewed candidate has over thirty years’ experience in mining industry with over decade experience as mining superintendent in top mining companies of Australia, such as Glencore, Peabody, etc. His experience within mine management includes site establishment, contract management, risk management, recruitment, mine planning and equipment management.HTL is dedicated to hire up to 50 employees from local area for our first stage development of Wateranga Project.

- Update of HTL’s EPCM team (06/02/2018)

HTL is actively organising working visas for our EPCM team, who has completed engineering design for our processing plant of Wateranga Project. The EPCM team will also construct the plant with custom-designed equipment to comply with Wateranga’s EIA documents in the near future.As industrial leading specialist masters innovative processing technology, HTL’s EPCM team is capable of bringing down our OPEX to 70% of similar project in Australia. They have independently designed and constructed over 100 mineral sand processing plant around the world with 100% achieved producing requirements since they engaged in mineral processing research in Panzhihua, Sichuan Province, China from 2003. - Drill Program Planning & Resources of Northern Wateranga Project (29/12/2017)

HTL has received proposal of conducting exploration works in Northern Target Area of Wateranga Project. The proposal includes two stages of works, those are:

Stage 1 – A report containing a proposed drill program that may be suitable for an Inferred Resource, comprising approximately 50 drill holes. The area covered will be the northern portion of the Unnamed Diorite at Good Night locality, near Wateranga. A Report outlining the results and a draft JORC Table 1 will be used to determine if Stage 2 will proceed.

Stage 2 (Optional) – A geological model (Micromine) based on the drilling results, and a JORC compliant Resource report identifying an Inferred Resource and will depend upon the results of Stage 1. - Road Safety Audit for haulage of Wateranga has been completed – Followed by last meeting with Department of Transport and Main Roads(TMR) regarding to the haulage route of Wateranga Project, HTL has completed the Road Safety Audit as requested, and the report has been submitted to TMR fore review. (11/12/2017)

- EPM 13278 Renewal Application – EPM 13278 Renewal Application has been lodged to retain all 25 sub-blocks of the tenement. The whole tenement of HTL will remain 77.6km2 with 14.97km2 of current mining lease area. (07/12/2017)

- Port of Bundaberg Group User Meeting – HTL attended the Port of Bundaberg Group User Meeting on 7 September 2017. During the meeting HTL and Port Authority finalized details of lease agreement of HTL’s stockpile land on Port Bundaberg. As discussed, HTL could lease the land for up to 25 years which will guarantee the stage 2 development of Wateranga Porject to be covered. Facility upgrades are also happening on Port of Bundaberg. Those upgrades will ensure the port will meet the needs of HTL for stockpiling, loading and shipment. (19/09/2017)

- High grade ilmenite in Wateranga North – According to preliminary analysis of potential ilmenite product from Wateranga North, the specification of Wateranga North ilmenite contains 53% TiO2, 35.25% total iron, 0.65% CaO and 0.15% MgO. This specification indicates that ilmenite from Wateranga North will be considered as superior quality product, that will gain favourable market price for HTL.(30/08/2017)

- Meeting with DTMR – HTL had a formal meeting with Department of the Main Road regarding to the use of state road for the haulage of HTL’s mineral products in the near future. Prior to the meeting, HTL has completed Road Impact Assessment as required for the proposed haulage route, and details of the report has been discussed during the meeting. After the meeting both parties are committed to work together to reach an agreement with this matter as soon as possible.(08/08/2017)

- HTL has received quotations from mining contractors for the mining operation of Wateranga Project. (07/06/2017)

- HTL has interviewed candidates of mine manager for Wateranga Project. (07/06/2017)

- HTL has singed confidential agreement with a major financial institution with regard to the fund-raising and development of the Wateranga Project.(24/03/2017)

- Pre-mining site investigation – HTL has conducted pre-mining site investigation with mining experts and engineers on 10 March 2017. A detailed mining plan will be drafted after this investigation in line with Environmental Authority. (13/03/2017)

- Mine site and port visit – HTL conducted mine site & port visit with institutional investor of HTL from China who is satisfied with the progress of Wateranga Project.(01/03/2017)

- HTL EPC technical meeting – EPC technical meeting of HTL was held in China office between HTL board member Mr. Kuang, China office general manager Frank Lee and EPC team representative. This meeting is to finalize EPC contract & payment details.(15/02/2017)

- 2017 Australia- China Business Exchange Fair – HTL has been invited to attend Sydney 2017 Australia- China Business Exchange Fair as exhibitor. The event will be held in the International Convention Centre Sydney (ICC Sydney) from 17th Feb to 18th Feb 2017.(10/02/2017)

- Applicant’s submission – HTL has lodged applicant’s submission to the Land Court of Queensland with respect to the compensation agreement with landholders. (06/02/2017)

- GSA NSW Division Annual Dinner – David Li,the CEO of HTL, who attended the annual dinner held by Geological Society Australia(GSA)as a member last week. This activity offered members a great opportunity to exchange experiences, share ideas,promote friendship with each other.(15/12/2016)

- HTL joined in Australian Public Companies Association (APCA) – HTL CEO David Li, as a fundamental member of APCA attended the Opening Ceremony of this association and made a speech. Many Chinese entrepreneurs and local councillors attended this activity which was held at Parliament House Sydney on 30th November 2016. APCA, as a bridge, aims to offer professional financial and legal service for Chinese companies which intend to invest and operate in Australia.(09/12/2016)

- HTL AGM 2016 has concluded – HTL AGM 2016 has concluded on 29 Nov 2016. The Consolidated Financial Statement with audit report was circulated to all attendees before the commencement of the AGM. If you are shareholders of HTL and you did not attend the AGM, please contact us by email: echen@htl.net.au to obtain a copy of the report. Minutes of the meeting is also available upon request.(02/12/2016)

- The Offer Document of water lease received – HTL is pleased to advice that the Offer Document from SunWater Limited has been received. This Offer Document refers to the lease of 1500 ML of medium priority water for our project from Paradise Dam.(30/11/2016)

- HTL has received EPC scheme – HTL board is pleased to announce that we have received EPC contract for the processing plant of Wateranga Project. For the first time, the potential EPC contractor has offered Wateranga Project with reasonably low CAPEX and guaranteed OPEX in terms of mine gate price, with which the board of HTL would be keen to continue to work through with potential contractor in order to achieve the best possible outcome toward the upcoming construction in 2017.(15/11/2016)

- HTL has received proposal of further works following the grant of Mining Lease 80116 – HTL has been preparing for obtaining the required final approvals for the Wateranga Project following the grant of Mining Lease (ML) 80116 and meeting the environmental compliance actions under the Environmental Authority (EA). The board of HTL has received proposal from our experienced tenement management team to undertake these works. Upon completion of works in the proposal, HTL could carry out construction and site works immediately for the target commissioning.(13/10/2016)

- HTL Joined Wide Bay Burnett Resource Group – HTL is pleased to announce that HTL officially became one of eight fundamental members of Wide Bay Burnett Resource Group (WBBRG). Wide Bay Burnett Resource Group was mainly founded to discuss and promote the development of resource projects in North Burnett Minerals Province. WBBRG also intend to provide members with the benefits of cost effective transport options, energy and water supply at a viable cost, access to adequate and effective communication technology and other economic development infrastructure. WBBRG has been generally led by the Department of State Development with active support from resource companies, Gladstone Ports Corporation, local government, other state agencies and allied industries. After joining WBBRG, HTL will integrate its industrial experiences with the resources and support from WBBRG to create more values for HTL’s investors.(10/10/2016)

- The spirals certified by CE certification – HTL’s prospective EPC Contractor has designed and manufactured a new cluster of spirals which was specifically utilised for the quality inspection and gravity pilot plant process. The quality inspection result of the newly-designed spirals has been certified by CE certification recently. While the result of processing test delineates that the performance of all aspects of the data has reached and exceeded the requirements in the EPC contract.(27/09/2016)

- HTL has received Water Supply Scheme – HTL has received Water Supply Scheme from SunWater Ltd. With scheme, HTL could calculate the cost of water consumption based on our water allocation within the Paradise Dam catchment which is only 3 kilometres in distance from the proposed processing plant, which has been become the continuously viable water supply since completion of the dam therefore, we believed it could meet our requirements in terms of sufficient water supply and budget control.(22/09/2016)

- HTL has received Power Supply scheme – The power supply scheme has been stated in detail presented by a potential supplier which has been involving in the mining industry in Australia for long history throughout its national affiliates. In the light of that, the director of HTL has visited its branch in Mackay QLD and received elaboration from the branch manager in terms of underlying application of the module to be potentially configured at Wateranga ilmenite project.(02/09/2016)

- Visit of HTL’s potential EPC Contractor’s plant (02/08/2016)

- Chairman of HTL(formerly QIM) David Li have met top management team of Hyundai Steel procurement in Singapore on 24th March. During the meeting, Hyundai Steel has shown huge interest in HTL’s ilmenite resources and downstream network with other slag and sponge plants that would be associated with HTL to produce and supply titanium slag and sponge, which will improve additional value of HTL’s products and diversify our market. HTL would have great potential to align ourselves with Hyundai as corporation in material and manufacture. (31/03/2016)

- QIM successfully conducted three road shows in metro cities of China for corner stone investors. Due to enthusiastic responses from potential investors, more road shows will be performed in Hong Kong and other major cities. (15/03/2016)

- Followed by a meeting between QIM and PE(private equity), both parties are organising roadshow for QIM in China this March. It is estimated that QIM will conduct more than three roadshows in major cities of China . (15/02/2016)

- QIM was invited and attended Regional Economic Development Growth Forum in Maryborough QLD on Thursday 5 November 2015. As an important local annual event, nearly 200 people attended this forum including QLD senator, five regional mayors and regional outstanding enterprises. QIM Chairman & CEO David Li made a roadshow presentation during the forum as invited by the organizer. As part of the presentation, David Li introduced the development strategy of the company and Wateranga Project to all audiences as well as welcoming potential investment opportunities in QIM’s IPO in 2016. It is believed that Wateranga Project could promote regional economy by not only hiring up to 200 local employees but also developing unique mining tourism to cooperate with regional tourism resources.(17/11/2015)

- QIM’s application for an extension of time to hold the company’s Annual General Meeting (AGM) on 19 October 2015 has been approved under sub-section 250P(2) of the Corporations Act 2001 to a date not later than 31 March 2016.(30/10/2015)

- On Wednesday 23rd September 2015, QIM board members and Sue Border as QIM’s independent geologist have met in order to further comprehend the information acquired through PFS. As the result of it, we deemed the conclusion of PFS was solid and down-to-earth and potentially can be further optimised in line with conservative assumptions of ilmenite price and exchange rate. And both parties have agreed to accomplish the ITR within 2-3 weeks as a significant part of the prospectus. (30/09/2015)

- QIM has appointed Greencap Limited to complete tenement report. Greencap Limited is QIM’s tenement manager that was formerly known as Environmental and Licencing Professionals (ELP). (17/09/2015)

- QIM was meeting with North Burnett Regional Council, Bundaberg Regional Council, Department of Transport and Main Roads, Department of State Development and logistics company in Biggenden on Tuesday, 25 August 2015. Meeting was held with technical experts to help QIM study the feasibility of using central haulage route from mine site to Port Bundaberg to shorten 80km haulage distance and reduce cost. During the meeting QIM presented significance of this central route and each party of the meeting expressed their opinions constructively. After the meeting central investigation was carried out by driving along this potential haulage route, and further activities will follow up in the near future. (28/08/2015)

- QIM was meeting with Robbins Technology Group in Brisbane on 07 August 2015 in order to further reduce operating and mining cost. Meeting was focused on improving processing rate from 250tph ROM to 750tph ROM along with more cost effective mining method. QIM believes that Wateranga Project’s viability and profitability will be enhanced with this new study direction to be completed within two weeks.(07/08/2015)

- QIM was meeting with North Burnett Regional Council mayor Don Waugh and general manager David Wiskar at Gayndah, QLD on 6th of August 2015. During this meeting QIM reported progress of Wateranga project, and how to promote regional economy with the development of QIM. It is estimated that Wateranga project will have approximate 200 local employees at mining stage 2, and QIM has the intention to develop and support local grazing industry. Potential opportunity of using shortcut heading northeast from mine site to significantly reduce haulage cost was also discussed and a further technical meeting was arranged to work out the feasibility of it. (06/08/2015)

- QIM embarked a road show to a fund manager of a reputable investment bank in Qatar. During the presentation, chairman of QIM David Li introduced Wateranga Project with analysis of market prospect, profitability of the company, and investment opportunities. The fund manager has expressed interest to the project and potential IPO in 2016. The manager has stated that he will respond to this investment opportunity in due course. (03/08/2015)

- Qim was meeting with Robbins Technology Group in Brisbane on 16 July 2015. Meeting was focusing on improving mining method and process plant procedure. (16/07/2015)

- QIM was meeting with Department of Transport and Main Roads & Department of State Development On 15 July 2015 in Bundaberg. Discussing and seeking for the best haulage way from Mine site to Port Bundaberg. (15/07/2015)

- QIM was meeting with Port Bundaberg Authority on 14 July 2015 at Port Bundaberg. Discussing future stock pile and shipment based on MoU previously signed. (14/07/2015)

- Five tons bulk samples are collected from central target area on 30 June 2015. These samples will be used for further metallurgical test work. (30/06/2015)

- On 15 June 2015, The administering authority has decided to allow QIM’s EA application for ML 80116 area to proceed. (15/06/2015)

- QIMH is actively sourcing additional fund to develop the Wateranga Project. QIMH has been approached by some large Chinese private enterprises for equity injection and become the substantial stakeholders in the company.

MARKET UPDATES

- Feb 2026 Global Ilmenite Market Update (25/02/2026)

In February 2026, the global ilmenite market remained robust. Driven by surging demand from the aerospace and high-end manufacturing sectors, high-grade feedstocks are outperforming traditional grades, leading to a “structural supply-demand tightness.”

[Key Market Dynamics]

Price Performance: In the Asia-Pacific market, 46% grade ilmenite concentrate is trading between RMB 2,250 – 2,450 per tonne. Meanwhile, mainstream imported ores (primarily from African and Australian origins) maintain a CIF price of USD 380 – 430 per tonne.

High-End Demand: Persistent growth in aerospace-grade titanium—with an annual growth rate of approximately 10%—is accelerating the strategic stockpiling of premium ore.

Process Transition: The global TiO2 industry’s accelerated shift toward the “Chloride Process” is resulting in sustained tightness and higher premiums for low-impurity, high-grade ilmenite.

Cost Floor: Rising global mining operational costs and increased ESG-related investments are providing a solid support level for current market prices.

[Future Outlook]

A moderate restocking cycle is expected to emerge in Q2 2026, following the seasonal recovery of the global infrastructure and automotive sectors. - Titanium Concentrate Market Brief – China Market (23/01/2025)This week, the titanium concentrate market in China has shown an upward trend:

- 46% TiO₂, 100-mesh (147µm) ore: Mainstream price ~$275-$282 USD/ton

- 47% TiO₂, 200-mesh (75µm) ore: Mainstream price ~$308-$318 USD/ton

- 38%-42% TiO₂ titanium middlings: Mainstream price ~$198-$205 USD/ton

(Exchange rate estimated at 7.1 CNY/USD, subject to fluctuations)

Compared to the same period last week, the average price increased by ~$2.11 USD/ton, reflecting a 1.06% rise.

Market Highlights

✅ Steady Uptrend – Prices continue to rise, indicating strong demand and a stable supply outlook.

✅ Optimistic Market Sentiment – The increase in titanium concentrate prices reflects positive momentum in the sector.

✅ Favorable Conditions – Market fundamentals remain solid, supporting continued growth opportunities. - Ilmenite market maintains a stable high price, while downstream markets continue to grow(16/10/2023)Since the second half of 2021, the price of 50A-quality ilmenite has been maintained at a high level of over $400 per ton for nearly two years. The latest report on the Chinese downstream titanium dioxide market in August 2023 shows an import volume of approximately 9,210 tons, with a month-on-month growth of 14.87%. The export volume is 137,480 tons, with a month-on-month growth of 1.19%. The domestic total production is approximately 346,140 tons, with a month-on-month increase of 20.67%. Apparent consumption stands at 217,869 tons, with a month-on-month increase of 37.02%.

- China C919 flying titanium alloy high(08/06/2023)Recently, the C919 airliner completed its first commercial flight. The amount of titanium alloy on the C919 aircraft reaches 9.3% of the weight of the fuselage structure, far exceeding the 4% of the Boeing 737 and the 4.5% of the Airbus A320 in the same class. The self-weight of the C919 is about 42 tons, which means that nearly 4 tons of titanium alloy are used on one C919.

- Ilmenite market size is set to grow at an impressive pace in the upcoming years till 2028(06/06/2023)Recent market report indicates that the global Ilmenite market size was valued at USD 2147.31 million in 2022 and is expected to expand at a CAGR of 13.09% during the forecast period, reaching USD 4492.42 million by 2028.

- Ilmenite prices stay high(20/03/2023)As of 16 March, 2023, the CIF price of China’s imported ilmenite(TiO2>50%) produced in Australia is 410 US dollars per ton. It is around the historical high spot in the same period of 2022 with 36% increase compared to 2021.The analysis believes that the reason why the price of ilmenite can maintain a high level for a long time is closely related to the global supply and demand gap and the expectation of further increase in future demand.

- Historical high price of imported 50% ilmenite in China(05/09/2022)CIF price of imported 50% TiO2 ilmenite in China has reached historical high of U$460 per ton by the end of August 2022.

China’s total imports of ilmenite in July increased by 20.45% year-on-year. According to the analysis of upstream and downstream industries, the price is expected to be stablised in the near future. - Australia’s 2022 Critical Minerals Strategy will grow our critical minerals sector (12/04/2022)Resources Minister Keith Pitt has announced funding to unlock potential of critical minerals sector:https://www.minister.industry.gov.au/ministers/pitt/media-releases/investment-unlock-potential-australias-critical-minerals-sectorA link to the Critical Minerals Strategy is below:2022 Critical Minerals Strategy | Department of Industry, Science, Energy and ResourcesAs part of Wateranga Project’s target minerals, titanium is listed as a critical mineral in the strategy, as well as scandium and zirconium.

- lmenite market quick update (27/01/2022)CIF price of imported 50% TiO2 ilmenite in China is still around USD400 per ton at the beginning of the year that has been stabilised for a while. According to the analysis of upstream and downstream industries, major price change is not expected in the near future.

- Ilmenite market update (03/06/2021)According to Titanium Market Weekly Report by Baiinfo.com, CIF price of imported 50% TiO2 ilmenite in China has reached U$340 to U$350 per ton. The price has been verified by HTL through our marketing team. With large demand from downstream and limited supply, the price is expected to be continuously and steadily increased in the following months.

- Spot ilmenite CIF price in China (11/03/2021)According to recent transaction of major pigment producers in China, CIF price of imported 50A quality ilmenite from Africa is between U$300 to U$330, that has been increased by roughly 30% since October 2020. With demand continues to grow and expectation of strong economic recovery in 2021, HTL believes ilmenite price will stay strong.

- COVID-19 and GDP present unique picture for mineral sands (28/01/2021)Excerpt from Mineral sands stocks on the ASX: The Ultimate Guide By Lorna NicholasHistorically pigment demand, and consequently titanium mineral consumption, is linked to GDP.It is also seasonal – experiencing the strongest demand during North America’s summer when home renovations etc are more prevalent.However, with the onset of COVID-19 a unique picture has presented.GDP was drastically down worldwide in 2020. But, with more people housebound and government stimulus incentives, smaller scale home renovations have continued – potentially mitigating some of the impact of a negative global GDP which was predicted to reach -4.4% in 2020.This was according to the International Monetary Fund’s October 2020 World Economic Outlook report.In Australia, the Reserve Bank’s November Monetary Policy Statement reveals an expected 4% contraction for the country in 2020.Both global and domestic GDP are expected to rebound in 2021. The IMF anticipates global growth will strengthen to 5.2%, while the RBA expects Australia’s GDP will increase to 5%.Both entities caution this is dependent on further virus outbreaks, resultant restrictions, and vaccine roll-outs.In comparison to the drastic fall in GDP, the erosion of mineral sands pricing and production has been much milder.Additionally, post COVID-19, government stimulus programs are anticipated in military and infrastructure, which will drive mineral sands demand – particularly in the US and China.

- Spot price of 50% TiO2 ilmenite from overseas market (28/10/2020)According to HTL’s first hand market research from overseas ilmenite buyers, 50% TiO2 ilmenite is sitting strongly around U$240 per ton and the demand market is still hungry for any available supplies.

- IBIS World – The Outlook for Australian Mining (12/10/2020)

- Minerals Council of Australia – Huge global opportunity for Australia’s mineral sands (21/09/2020)

- Strong ilmenite demand continues (10/09/2020)Australian mineral sand miner noted continuing firm demand from customers during the quarter supported further upward movement in ilmenite prices, while rutile and zircon prices remained steady.

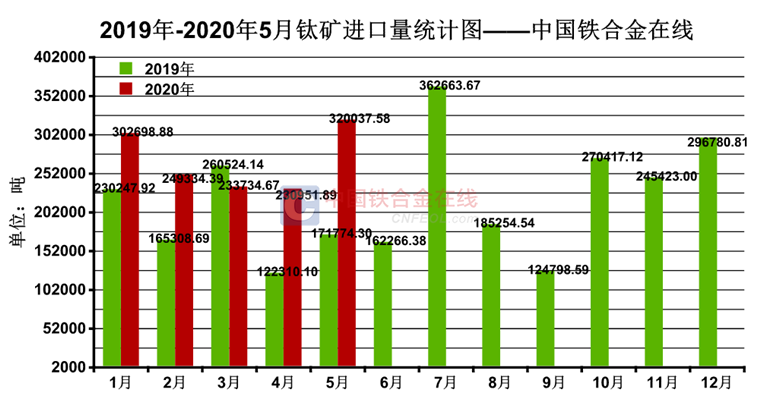

- China imported 41% more ilmenite from Jan to May 2020 than the same period of last year (25/08/2020)Market research from FerroAlloyNet.com has shown monthly comparasion of ilmenite imported by China from January to May 2020 and same period in 2019. We see 41% increase in total of this period although global economy was affected by COVID-19 this year.

- HTL ilmenite market analysis (01/07/2019)According to HTL’s first-hand market research, China’s ilmenite market has gradually stabilized this week, and the pre-tax FOB price of imported 50% TiO2 ilmenite has increased to US$270/ton.

- Bundaberg News Mail – MINING FOR NEW EXPORT – Export opportunities grow as work gets underway to extract versatile mineral from site near Bundy (30/01/2020)

- China’s ilmenite market update in December (16/12/2019)Currently the supply of imported high-quality ilmenite continues to be tight, the overall market is in short supply, and prices remain high.

- Tight supplies of the mineral sand ilmenite has led to a second price increase in two weeks for the titanium dioxide feedstock. (23/09/2019)Limited availability and restricted supplies are propelling concentrate prices up with steady demand for sulphate ilmenite in China and Europe, according to industry sources.

- Shortage of imported ilmenite supply in China (24/07/2019)Recently in China, the import of ilmenite market is still active, especially in the case of significant domestic inventory being consumed. However, most of the miners outside China still do not have much stock supply. On the hand, the spot is tight, and the demand in the international market is increasing, which leads to the scarcity of the amount going to China. On the other hand, due to environmental factors, most countries of miners have imposed export restrictions on ilmenite.According to industrial website, India and Vietnam, the main suppliers of titanium ore in China, have not resumed normal supply to the Chinese market so far. Indian miners are still waiting for the government to lift the ban, and Vietnam’s export quota has been delayed.In addition, the titanium mines in Kenya and Mozambique will not be available for sale in the near future, so they have not yet resumed their offer.

- Supply-demand of global titanium raw material will not change in 2019 (05/02/2019)

Origin: RuidowTiRecently, the world’s major titanium raw material producers have announced the production and operation in 2018, and made preliminary predictions on the market in 2019. After reviewing the reports of several companies, it was found that each company basically showed similar conditions, and this is also the general trend of the development of titanium raw materials market in 2018 & 2019.In 2018, the output of major titanium raw material companies in the world has not increased, and the output of many producers has declined for various reasons. Among them, several companies have experienced the end of the mine life cycle. With the decrease of remaining reserves and rich ore content, the output of some mines in 2019 will continue to decline. The development of new mines and the extension of existing mines are still in progress, but it is impossible to compensate for the decline of production in 2019, which in turn will affect the global supply of titanium raw materials.

Ruidao believes that the high total imports of titanium concentrate in China in 2018 mainly reply on the low-quality titanium concentrate and middlings, and the supply of high-quality titanium concentrate and rutile is still relatively small. At present, the domestic market has initially reflected the trend of differentiation. It has shown that demand for high-grade raw materials is robust with firm prices and even rising. On contrast, low-quality raw materials are under sales pressure with slow sales and poor prices. Ruidao believes that this situation will continue or even further intensify in 2019.

- The Global Titanium Dioxide Market (2018-2023): Increase in Demand for Lightweight Vehicles in the Automobile Industry (14/01/2019)

Origin: ResearchAndMarkets.comThe market for titanium dioxide is expected to register a moderate CAGR during the forecast period, 2018 to 2023. This growth is primarily driven by the rapidly growing demand for paints & coatings and increase in demand for lightweight vehicles in the automobile industry.Lightweight plastics are in high demand in the automotive industry due to their competitive pricing, style, reliability, strength, and safety. Plastic components weigh almost 50% lighter than similar components made from traditional materials, thus providing 25%-35% improvement in fuel efficiency, which is a key factor in the automotive and transportation industry. Every 10% reduction in the vehicle weight is estimated to result in a 5% to 7% reduction in fuel usage.Polycarbonates are the most widely used lightweight plastic material to replace the traditional materials such as bronze, stainless steel, cast iron and ceramics in the automotive industry. Polycarbonates are characterized by their low scratch resistance, which makes it unfeasible for its usage in automotive applications. However, by the addition of titanium dioxide to these plastics, their scratch resistance, light resistance, heat resistance, and weather resistance is rapidly increased making them feasible for use in automotive applications.The global automotive industry has registered a growth of 2.36% Y-o-Y in 2017 over 2016, reaching a total of 97,302,534 vehicles. Currently, to manufacture a typical four-wheel vehicle, 10 kgs of polycarbonate is used in various forms. With polycarbonate expected to replace conventional materials in the aforementioned industry, the demand for titanium dioxide is expected to grow at a rapid pace in the coming years.

- Titanium dioxide market is seeing price surge. Related listed companies are beating estimates.(13/11/2018)According to media reports, before 1 October 2018, many titanium dioxide companies issued price adjustment letters. Due to the rising prices of bulk raw materials such as ilmenite, the cost of titanium dioxide has increased significantly. The domestic price of titanium dioxide has been raised by 300 yuan/ton from now on. Internationally the price has Increased by $50/ton. The industry believes that the peak demand season for titanium dioxide in the second half of the year is coming, due to various factors such as continuous environmental protection pressure, small capacity withdrawal, natural gas supply change, shutdown and production restriction policy, and the reduction of international titanium dioxide giants, the price of titanium dioxide will rise again.

- Market update from Global Titanium Feedstock Conference 2018 (07/06/2018)Global Titanium Feedstock Conference 2018 was held in Ningbo, Zhejiang Province, China on 24 May 2018. More than 300 representatives from the industry around the world attended this event. HTL was invited as the guest speaker to introduce the future development prospects of Wateranga Project and the company, which has caused widespread repercussions.The titanium feedstock market has entered a new boom period since 2017. The supply and demand of titanium feedstock are both vigorous, and the price of ilmenite continues to rise. There was even a supply shortage in the second half of last year. According to statistics, in 2017, China produced a total of 3.8 million tons of ilmenite, which is a year-on-year increase of approximately 9.1%. At the same time China imported about 2.93 million tons of ilmenite, which was a 16.9% year-on-year increase. In total, the production of titanium dioxide exceeded 2.8 million tons, and the export volume exceeded 800,000 tons, both hitting a record high.According to the conference organizer data, in 2017, China’s consumption of titanium feedstock accounted for more than 40% of the global total. With the continuous increase in the production of downstream products such as titanium dioxide and titanium sponge, it is expected that by 2020 China’s consumption of titanium feedstock will be more than 50% of the global total consumption.

- Titanium – The key to the future world (22/05/2018)With the rapid development of the automotive industry, titanium has become the industry’s favourite for its lighter but stronger character. There is no doubt that titanium is the best viable solution to reduce vehicle weight. Supposedly by switching to titanium the company Lotus has reduced the mass of an Exige S sub-frame by 36 percent, dropping it from 110 pounds to less than 71. But that’s not all, stiffness has allegedly risen by about 20 percent.Known as the metal of the future, titanium is not only taking over the future of automotive industry, but also leading the development of technology and cutting-edge applications worldwide. HTL is interconnecting with titanium application research institution and downstream high-end manufacturing companies. It is possible for HTL to establish partnership with them in the future.

- 35 Minerals Absolutely Critical to U.S. Security (12/03/2018)The U.S. Department of the Interior announced it is seeking public comment by March 19, 2018, on a draft list of minerals considered critical to the economic and national security of the United States.

The draft list of minerals that DOI published as critical to the United States includes 35 mineral commodities. We have noticed that a few minerals from the list are target minerals of HTL’s Wateranga Project, such as- Titanium, overwhelmingly used as a white pigment or metal alloys. This is main target mineral of current mining lease area.

- Scandium, used for alloys and fuel cells. According to JORC 2004 report, Wateranga Project also has 149Mt Scandium resources @30ppm. Scandium can be extracted from HTL’s further processed ilmenite, e.g. from the waste acid of pigment manufacturing flow, in which scandium will be enriched to approx. 100 ppm.

- Zirconium, used in the high-temperature ceramics industries. Zircon is one of the by-product HTL will produce in the future. Hardrock deposit of Wateranga contains about 1% zircon.

- China ilmenite market update (14/02/2018)According to market report from Panzhihua Vanadium & Titanium Trading Centre, by the end of January 2018, ilmenite price keeps rising in Panzhihua area of China, with mainstream price of followings:Panzhihua 46% TiO2(Exclude tax): USD190 – USD205 / ton

Panzhihua 47% TiO2(Exclude tax): USD197 – USD212 / ton

India 50% TiO2: USD250 – USD270 / ton

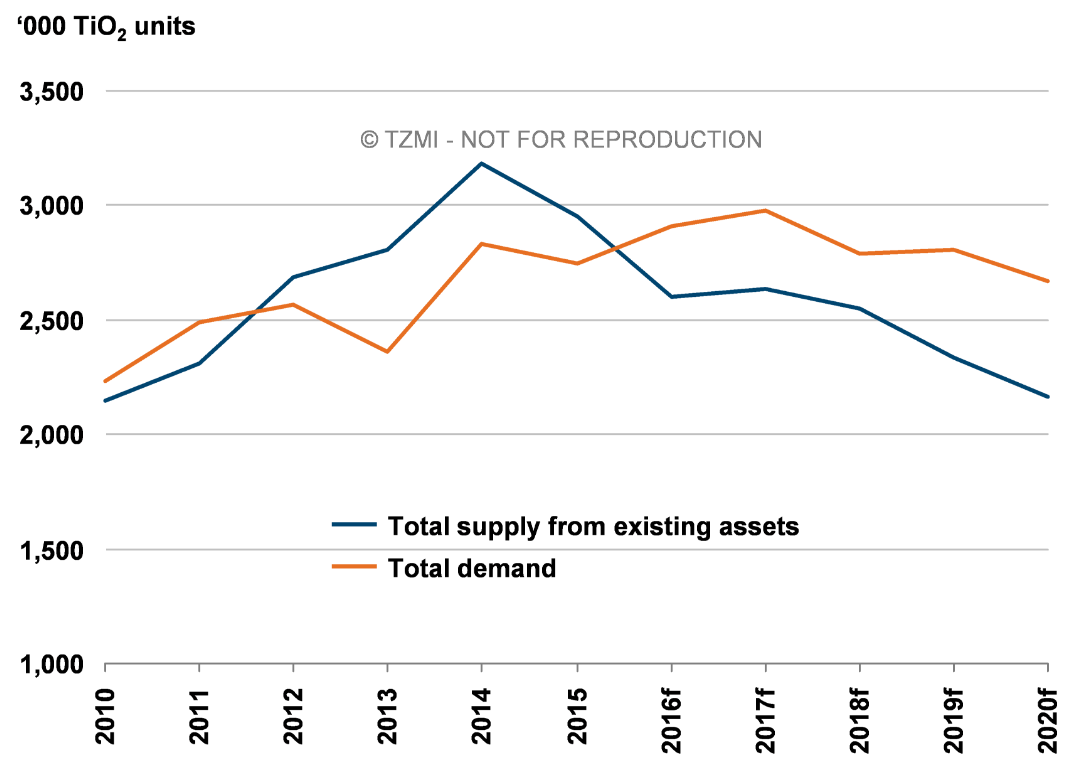

Mozambique 50% TiO2 (CFR): USD260 / tonBased on the development plan of Central area of Wateranga, HTL is pursuing ilmenite production by the end of 2018. - TZMI Titanium feedstock update (19/01/2018)According to reputable mineral sand reporter TZMI’s market update in the end of 2017, most feedstock producers reported strong market conditions in Q2 2017 with increases in sales and volumes as well as an uplift in prices. Many also reported record production levels in half year and/or full year reports.TZMI continues to forecast demand growth to outperform supply growth during the next few years unless new supply becomes available from new projects. New projects will need to be brought onstream from 2019 to avoid supply deficits.

- Major ilmenite producing area in China is under continuously strict environmental protection supervision. The market continues to be in short supply. (20/09/2017) According to market research by FerroAlloyNet.com on 18 September 2017, as the largest ilmenite producing area in China, Panzhihua area is still under strict environmental protection supervision which leaded to lower production rate from this area than expected. There are only a few companies still producing while others are all in suspension. Ilmenite supply shortage from this area continues and it is believed that ilmenite market price will continue to rise.

- Tight Ilmenite supply in China(08/08/2017)According to ilmenite market report from FerroAlloyNet.com in August 2017, most local ilmenite producers in China are suffering from suspension due to increasingly strict environmental protection supervision. It is known that only a few ilmenite producers in West Panzhihua are in normal operation. For this reason, most producers are holding stock as price keeps going up, and this situation is not expected to be changed in the near future.

- Ilmenite price continue to rise. A need for new supply from 2018 is expected(24/04/2017)According to the latest market report from TZMI, TZMI expects excess feedstock inventory from the past few years to be worked through by 2018 with overall inventory continuing to be depleted even with any new supply coming on line. Even so, TZMI still expects a need for new greenfields supply from 2018.Prices of sulfate ilmenite have continued to rise with TZMI expecting higher prices in 2017.

- The ilmenite shares were much sought after (15/03/2017)According to the report of Wanzhong Financials, ilmenite sector of China stock market has surged to be more than double since 2017, and ilmenite-related stocks have become one of the most popular sections in Chinese stock exchange.Data of the Business Association shows that one of the top three ilmenite producers in China has risen its ilmenite price twice this week, 100RMB each time. Ilmenite price has gained 13% rise from this week and the latest offer is 1,750RMB/ ton. Ilmenite price has increased by 38% this year and 230% comparing to the price of early last year.The Pacific Securities believes the significant price rise of ilmenite leads to the rise of titanium dioxide price. Before the rise of titanium dioxide price is mainly due to the Demand-supply relation change, stricter environmental management plan and increment of exportation. Ilmenite price has increased by 38% since November 2016 and the leading titanium dioxide producers have risen their price 12 times since 2016.

- Ilmenite market price after Chinese New Year (10/02/2017)According to market report from China after Chinese New Year, the CIF China transaction price of 50A quality ilmenite for pigment manufacture is currently standing from USD 220 to USD 240 per ton.

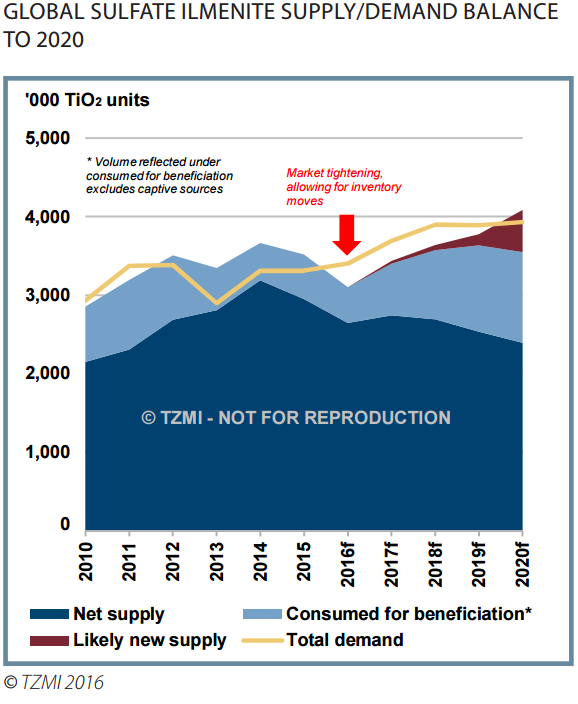

- Sulfate ilmenite shortage by 2018 without new projects: TZMI (25/01/2017)Without new mines the sulfate ilmenite market will be in shortage by 2018, according to the global independent expert TZ Minerals International (TZMI) in its recently released quarterly Market Update for the titanium and zircon value chains.The looming shortage is already pushing prices up in 1H 2016, particularly in China for domestic ilmenite. China is expected to lead demand growth for sulfate ilmenite in the next few years for direct use in its sulfate process route dominated pigment sector.

TZMI Supply and demand forecast for sulfate ilmenite 2010-2020

The net result, according to TZMI’s analysis, is that after a number of years of supply surpluses, excess sulfate ilmenite inventory is now being worked off and the market is heading into a period of sustained shortages from as early as 2018 without supply from new mines.

TZMI anticipates global sulfate ilmenite price increases gaining momentum in 2H 2016 as the domestic price increases in China impact imported sulfate ilmenite prices.

Overall TZMI expects a more buoyant market for a number of feedstock products, and especially sulfate ilmenite, in 2017.

- Nano-Titanium Dioxide inactivates cancer cells(15/12/2016)Nano-Titanium Dioxide has a wide range of uses. According to relevant data, Nano-Titanium Dioxide can inactivate cancer cells, control odour. It is quilt effective for curing of nitrogen and for the removal of oil pollution. In addition, it is also useful for destroying microscopic bacteria and odours.Photocatalytic Activity of Nano-Titanium Dioxide Particles has a wide range of uses in environmental protection. There are many literatures at home and abroad reported on this progress. A novel photocatalytic technology at room temperature was developed by a British company. This technology utilises artificial light and Nano-Titanium Dioxide catalyst to resolve the Polychlorinated biphenyls in industrial waste water and contaminated groundwater. When the sewage through the Titanium Dioxide coating network, the reaction that resolve organic poisons into carbon dioxide and water takes place as long as the exposure to low doses of ultraviolet light.Furthermore, the use of Nano-Titanium Dioxide as a photocatalyst material can also catalytic degradation the dye pollutants caused by textile printing and dyeing industry and the photographic industry. With the development of social economy, people pay more attention to the improvement of life quality and health level.

- The market price of Ferrotitanium is ‘climbing’ steadily(25/11/2016)Recently, the price of aluminium powder is not stable, but on the whole, it is in a state of growth. Until now, the purchase price of most companies is even more than 14,000 Yuan per ton. As a result, the production cost of Ferrotitanium market has been directly pulled up. In addition, steel mills have relatively stable demand for ferrotitanium, thus the supplier’s sale price is increasing. According to the chemical assay by authority organization and feedback by downstream manufacturers, the ilmenite(50A) of HTL can be used to product ferrotitanium directly, as well as various well known products, such as titanium dioxide, titanium sponge, titanium slag, etc.

- The “millennium”of Titanium dioxide industry is coming (27/10/2016)China’s export volume of titanium dioxide hits a new high at 60,000 tons in March 2016, with 30.15% year to year growth rate and an increase of 36.55% over the previous month

According to market research, about 746,000 tons of titanium dioxide productivity which is more than 10% of current global capacity, exited in the last four years globally. Until the end of 2015, the effective capacity of China is only 2,800,000 tons which is much less than market expectation. According to the new industrial standard” Titanium dioxide unit product energy consumption limits”implemented from October 2016, it is expected that 20% of productivity will phase out more quickly. Due to the supply reduction in 2016, Titanium dioxide industry is expecting a long rising streak.

The vice executive secretary of Titanium Dioxide association Jie Deng announced in industry annual meeting in March 2016 that, there is no doubt the price of Titanium Dioxide will keep increasing in a bullish channel. The price of Titanium Dioxide will probably reach the historical peak at ¥ 20,000 per ton, thus leads to a “millennium” of this industry. - The Secret of Sun Cream—Titanium Dioxide (7/10/2016)

There are many substances are white in the world, for example, the snow and cotton. However, people barely know the whitest substance in this world—Titanium Dioxide.

The relevant data delineates that … - Titanium Dioxide in a booming market: Global Ilmenite Concentrate Price Risen Continuously (29/09/2016)

The Titanium dioxide market has been in a high demand currently, however, many manufacturers still have difficulties to reach the ilmenite concentrate as the feed stock. Even some Chinese miners do not have the stock of ilmenite concentrate as well at the moment. In the case of some regular clients in a rush for commodities, their only choice is to make orders from overseas. The quota restriction of Ilmenite concentrate from Vietnam authorities resulted in that the scarcity of Ilmenite concentrate in Chinese ports from Australia. To that end, most of the end users have to line up for long to collect the ilmenite on the ports. These factors all contribute to the fact that the Australian ilmenite concentrate price has been staying at a high level.

The industry and market analysis delineates this boom will not cool down until the Chinese New Year of 2017. While, some international traders believe that after that ilmenite concentrate will still maintain a heavy demand based on the global market analysis.

- Ilmenite price turns bullish in China (16/09/2016)

- Undiscovered Scandium Market Set to Boom (12/07/2016)

- According to market analysis in April 2016 from China-ASEAN Mineral Resources, spot supply of ilmenite is tight and ilmenite price is strong and steady. Titanium dioxide market expects to rise due to rigid demand from downstream market (15/04/2016)

- Solar to help power remote north QLD mine (30/09/2015)

- Why Commodities Could Soar During the Next Bear Market (17/09/2015)

- Titanium dioxide market is expected to reach USD 17.12 billion by 2020, expanding at a CAGR of 3.8% From 2014 to 2020

- Global total feedstock demand is forecast to increase by 3.6 million TiO2 units to 8.8 million TiO2 units between 2009 and 2018.

- Predicted global titanium demand will reach 25 million tons in 2015.

- Queensland Industrial Minerals Holding Ltd is preparing for public listing.